The Federal Trade Commission’s case against Qualcomm, as I have previously opined, is a dispute that shouldn’t be ignored.

Judge Lucy Koh of the Northern District of California recently denied Qualcomm’s motion to dismiss the FTC’s case. Now both parties have an opportunity to prove before an American court whether Qualcomm is bilking American companies and consumers as has been charged.

Qualcomm licenses and manufactures baseband chipsets used in smartphones allowing them to communicate with one another over mobile networks. The technical name for it is interpolation – and they have committed what amounts to information superhighway robbery to protect their stranglehold on the chipset market through a calculated strategy of anticompetitive licensing abuses.

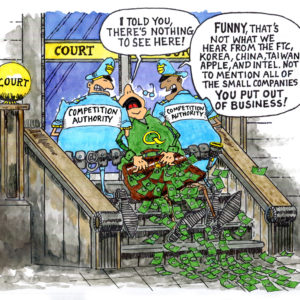

This needs to be stopped. The future of competition for connected devices depends on it. Over the last few years Qualcomm has faced a swarm of criticism from competition authorities around the world including the Korean Fair Trade Commission and from private companies from Broadcom to Texas Instruments to Intel and Apple – all leaders in their fields – regarding their questionable licensing business.

In most cases the market corrects itself and punishes misbehavior without the intervention of regulators. However, when a bad actor blatantly leverages its market power and ignores its obligations, the expert regulator, the FTC – as the cop on the beat – has to step in. In the case of Qualcomm, after years of licensing abuses that some think are akin to a good, old-fashioned shakedown, it’s time for the FTC to take a stand.

How Qualcomm licenses their Standards Essential Patents is the core issue in this case because SEPs are not ordinary patents and receive a special designation for multiple reasons. SEPs are critical to cooperation between different technologies. Holders of SEPs are effectively granted a collusive monopoly over an essential technology in exchange for agreeing to license the technology under Fair, Reasonable, And Non-Discriminatory terms as defined by law.

In the opinion of many experts who have examined Qualcomm’s practices there is nothing fair, reasonable or non-discriminatory about Qualcomm’s practices.

Every smartphone manufacturer is forced to pay Qualcomm a five percent royalty fee on the entire sale price of the device. No other SEP patent holder levies such a hefty fee. Qualcomm also completely denies licenses to competitors to ensure it remains dominant in the marketplace.

The FRAND – Fair, Reasonable, And Non-Discriminatory – doctrine protects consumers and encourages vibrant competition by ensuring broad access to SEPs. It provides newcomers and smaller entrepreneurs the opportunity to compete against the big boys like Qualcomm. Smaller innovators have a vital role to play in 5G and the Internet of Things markets which are essential to the future of American economic growth – another reason why this case it so important.

Qualcomm is raking everyone – its competitors, its customers and consumers – over the coals. By some estimates its licensing practices have driven up the cost of each smartphone by $30. Some people might say “So what?” but when you actively lobby to get your SEPs included in cellular standards under FRAND terms then turn around and ignore your obligations so you can stick it to manufacturers you do harm to the supply chain and the industry.

Qualcomm of course won’t admit any of this. It spends a lot of money glossing over the FTC’s case as though it had no merit, claiming its “inventions are the foundation” of many great American achievements. The FTC’s case against it is not a partisan issue. Rather it’s about the devastating impacts one company’s actions will have on American innovation and consumers.

The tide is turning. Competition authorities around the world have finally taken notice. They are cracking down on Qualcomm, which continues to maintain we should all just move along because “there’s nothing to see here.” No one should turn a blind eye here, especially advocates of free market practices and fair competition. The consequences of doing so extend far beyond this one case which, wrongly decided, may set the policies driving technological innovations on its ear for years to come.